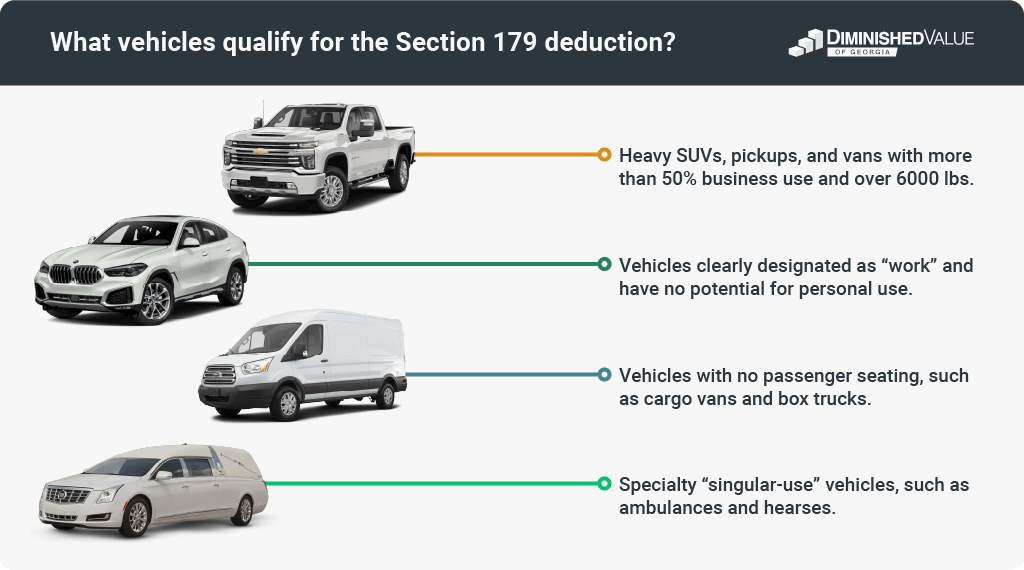

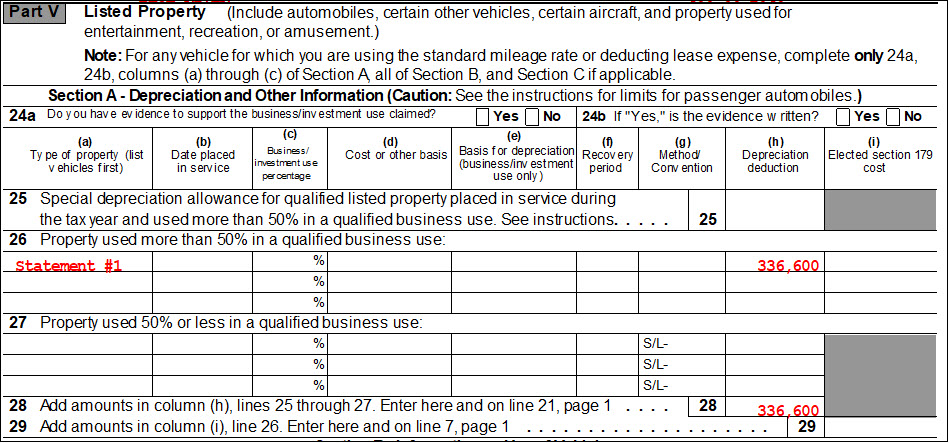

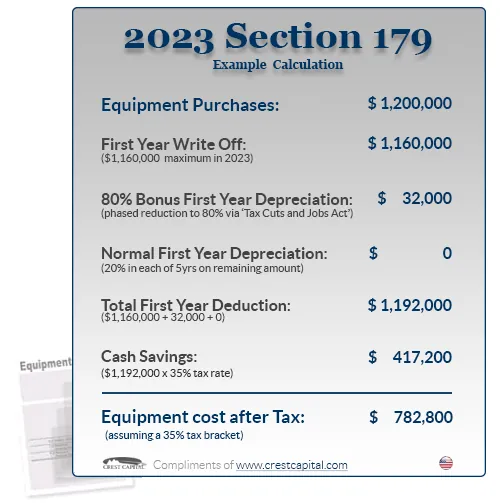

Section 179 Deduction Vehicle List 2024 Form – “Tangible,” meanwhile, means it has a physical form the section 179 deduction as tangible personal property. Computers, cash registers and production machinery are all examples. Vehicles . These exceptions are primarily smaller passenger vehicles or cargo vans. The Section 179 deduction is claimed by completing Internal Revenue Service Form 4562 and attaching the form to a business .

Section 179 Deduction Vehicle List 2024 Form

Source : diminishedvalueofgeorgia.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Deduction Vehicle List 2023 Mercedes Benz of

Section 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comList of Vehicles Over 6000 lb that Qualify for the 2023 IRS

Source : www.taxfyle.com4562 Listed Property Type (4562)

Source : drakesoftware.comHow To Deduct HVAC Equipment Purchases For Your Business With

Source : gopaschal.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Deduction Vehicle List 2024 Form List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when substantive . Section 179 Deduction and they can deduct vehicle costs as a business expense on the Schedule C tax form. There are two ways to calculate the deduction. One is to add up the actual cost .

]]>